Bronzeville Single Family Homes

Bronzeville Single Family Homes sold well in 2019.

A total of 112 homes were sold. This is up 33% versus 2018.

The average selling price for a single family home was $486,975.

The average selling price was up 18% versus the previous year.

The average market time increased by 23 days versus the previous year.

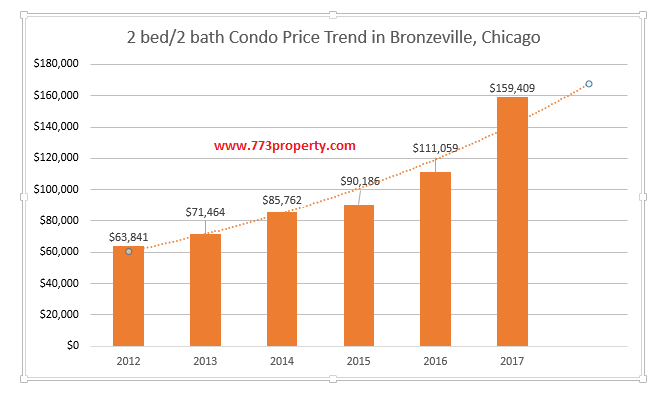

Bronzeville Condos

Bronzeville Condos also sold well in 2019.

A total of 272 condos were sold. This is up 12% versus 2018.

The average selling price for a Bronzeville condo was $199,455.

The average selling price was up 5% versus the previous year.

The average market time decreased by 4 days versus the previous year.

Bronzeville 2 to 4 unit buildings

39 multi-unit properties were sold in 2019.

That is an 8% increase versus 2018.

The average selling price was $341,995.

The average selling price was up 15% versus the previous year.

The average market time decreased by 73 days versus the previous year.

Bronzeville Rentals

244 units were rented in 2019.

That is a 24% increase versus 2018.

The average rental price was $1,530.

The average rental price was actually down 4% versus the previous year.

The average market time increased by 5 days versus the previous year.

Bronzeville Land

19 parcels of land were sold in 2019.

That is a 27% decrease versus 2018.

The average selling price was $90,289.

The average selling price decreased by -44% versus 2018.

However, this may not be an apples to apples comparison.

This is because every parcel of land is a different size.

Land value is driven largely by location, square footage and zoning type.

Summary

Overall, 2019 was a great year for Bronzeville real estate.

The biggest gains were seen in the Single Family Home category.

Values for Single family homes were up 18% in 2019.

This was driven largely by sales of new construction homes.

Multi-Unit properties also appear to be in great demand.

Values are up 15% versus the previous year.

Also, the average time it took to sell a multi-unit property was

cut in half versus 2018.

This is an indication that demand for this property type is high.

Contact Mark

If you have any questions about Bronzeville real estate,

please call or text me at 773-354-6693.

Thanks, Mark Killion

Kale Realty – Chicago, IL

Cell: 773-354-6693

email: mark@markkillion.com

website: www.buybronzeville.com